However there are individuals and entities who are supposed to register. Do all categories of taxpayers need to have income tax number.

7 Tips To File Malaysian Income Tax For Beginners

Tax Identification Number TIN According to the notice from the Inland Revenue Board of Malaysia the Tax Identification Number TIN has been officially implemented starting from 1st January 2022.

. The Inland Revenue Board of Malaysia IRBM assigns a unique number to persons registered with the oard. The Government during the 2022 Budget Speech tabled in the Dewan Rakyat on Friday 29 October 2021 has announced the implementation of tax identification number TIN to be implemented beginning year 2022 to broaden the income tax base. Perfect answer 08022022By Stephanie JordanBlog You may find out by phoning the LHDN Inland Revenue Board be prepared to provide your identification card or passport number.

How To Check Employer Income Tax Number Malaysia. This number is issued to persons who are required to report their income for assessment to the Director General of Inland Revenue. Kindly state the valid and correct and.

FAQ On The Implementation Of Tax Identification Number. Obtaining an Income Tax Number Visit the official Inland Revenue Board of Malaysia website. How to do e-Filing for Individual Income Tax Return.

Click on ezHASiL. Whether buying a car or properties in the name of an individual or a company must have a TIN. Alex Cheong Pui Yin.

SEMAKAN NO CUKAI PENDAPATANSYARIKAT MALAYSIACara Check Income Tax Number Online Sekiranya anda pembayar cukai sama ada individu atau syarikat yang telah berdaftar semestinya anda mempunyai nombor cukai pendapatan Malaysia. - Name and address of the receiver Foreign country of the receiver Receivers company registration number Passport number Date of birth of the receiver Type of payment Fill up information in e-TT Document submission. Any taxpayer who falls into any of the following categories is required to have an.

Malaysians Will Be Assigned Tax Identification Numbers In January 2021. Malaysian Income Tax Number ITN or functional equivalent In Malaysia both individuals and entities who are registered taxpayers with the Inland Revenue Board of Malaysia IRBM are assigned with a Tax Identification Number TIN known as Nombor Cukai Pendapatan or Income Tax Number ITN. Go through the instructions carefully.

Income Tax Return Form ITRF ezHASil e-Filing is a most convenient way to submit Income Tax Return Form ITRF. Fill in the Information Fill in the related information Then click Submit 3. Visit the official Inland Revenue Board of Malaysia website.

Click on the borang pendaftaran online link. To check your income tax number go to httpsedaftarhasilgovmysemaknocukaiindexphp Choose your identification type New IC numberPolice ICArmy ICPassport number Key in the identification number of the selected identification type. How can I check my income tax number online Malaysia.

Or you can apply in writing to the nearest branch to your correspondence address or at any IRBM branch. The registration can be done by sending an email to HelpPendaftaranNRhasilgovmy The details in the email shall include. It also saves a lot of time and very easy to complete it online rather than conventional methods by manually filling up the form.

How can I get my income tax number. Obtaining a Federal Tax Identification Number Visit the official website of the Inland Revenue Board of Malaysia. For your IT150 log in to your account and then click on the Notice of registration icon on the Home page to see your account information.

Documents Required for Registration. The e-Daftar symbol or link should be selected. Taxpayers who already have an income tax number do.

Category File Type Resident Individuals and Non-Resident Individuals SG OG Companies C 2. Account number of your bank. Nombor Cukai Pendapatan yang boleh digunakan untuk melakukan semua urusan dengan LHDNM atau.

03-8911 1000 local number 03-8911 1100 international number 03-8911 1000 local number. Go through the instructions carefully. Click on the e-Daftar icon or link.

Search Result It will show No Record Found as shown if you do not have an income tax number If you have registered before your income tax number will be shown see next step 4. Cukai Pendapatan Anda Terlebih Dahulu. Your income tax refund will be done through.

Key in the security code displayed on the right side of the page. Review the instructions attentively. Click on the e-Daftar icon or link.

PIN number First time Login can be obtained through HASiL Customer Feedback Form on the Official Portal or walk in to HASiL branches. Bernama Starting from January 2021 all. Application to register an income tax reference number can be made at the nearest branch to your correspondence address or at any Income Tax Offices of your convenience without reference to your correspondence address.

Click on the borang pendaftaran online link. Electronic Fund Transfer EFT to your bank account. IRBM has provided an online facility e-Lejar to allow you to.

To check whether an Income Tax Number has already been issued to you click on Semak No. 14th January 2020 - 2 min read Image. FREQUENTLY ASKED QUESTIONS FAQ.

Application to register can also be made through online. A Notice of registration of company under section 15 Companies Act 2016. You can request the issuance of the IT150 Tax reference number by sending an SMS to SARS on the number 47277 South African Revenue Service.

How can I check my tax number online Malaysia. Tax identification number is an INCOME TAX NUMBER as per existing records with the Inland Revenue Board of Malaysia HASiL. A Private Limited Company.

Malaysians Will Be Assigned Tax Identification Numbers In January 2021. The borang pendaftaran online link should be selected. This unique number is known as Nombor ukai Pendapatan or Income Tax Number ITN.

Click on e-Daftar. Information on Taxes in Malaysia.

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

.png)

How To Check Your Income Tax Number

How To Pay Your Income Tax In Malaysia

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Individual Income Tax In Malaysia For Expatriates

How To File Your Taxes For The First Time

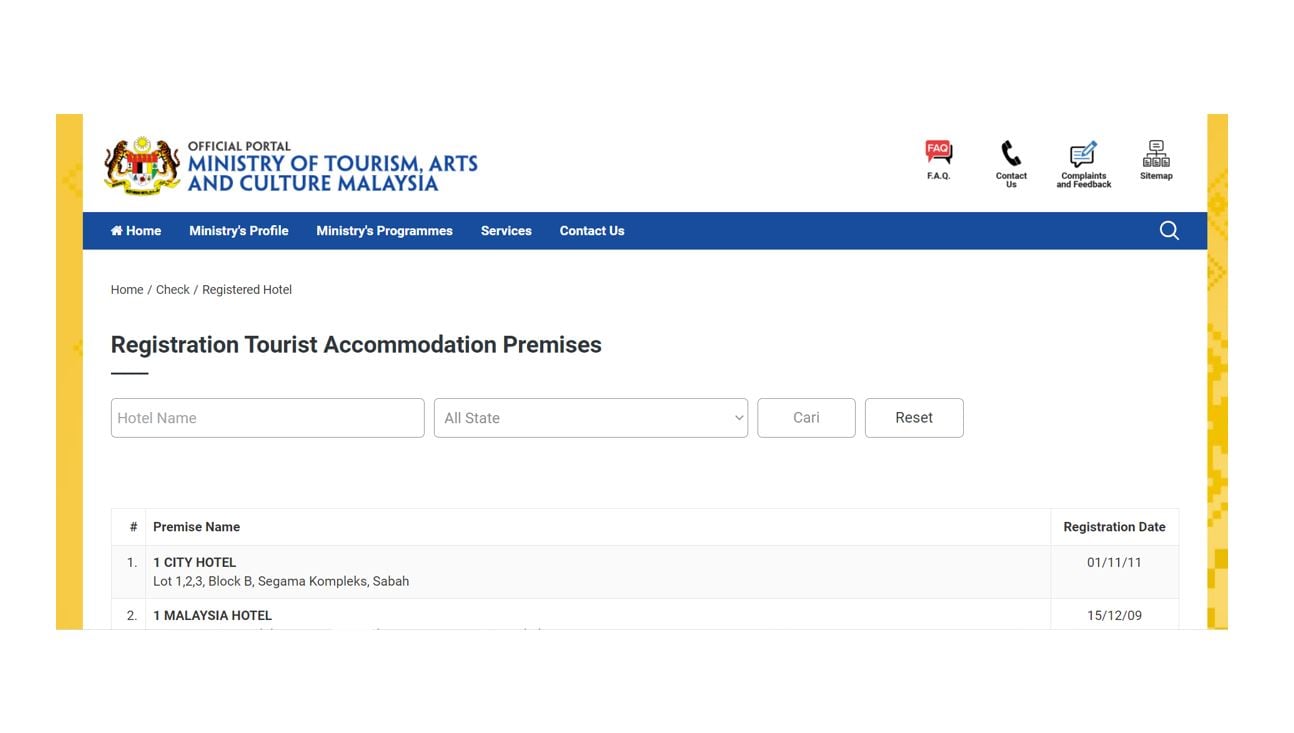

How To Check If Your Hotel Stay Is Eligible For The Tourism Tax Relief

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

7 Tips To File Malaysian Income Tax For Beginners

Tips For Income Tax Saving L Co Chartered Accountants

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Avoid Lhdn S 300 Tax Penalty Here S How To Declare Income Tax

15 Tax Deductions You Should Know E Filing Guidance Financetwitter

7 Tips To File Malaysian Income Tax For Beginners

Cukai Pendapatan How To File Income Tax In Malaysia

How To Check Your Income Tax Number